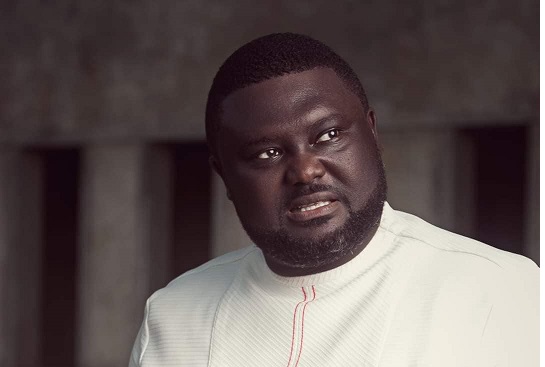

Member of Parliament for Nsawam-Adoagyiri, Frank Annoh-Dompreh has said the introduction of the e-levy in the 2022 budget statement presents innovative and equitable ways in generating revenue for critical projects.

In a tweet after the presentation of the 2022 budget statement by the Finance Minister Ken Ofori Atta on Wednesday November 17, he said “Government decision to scrap tollbooths is a bold move to reduce the burden on drivers, while the introduced e-levy, presents an innovative & equitable approach to raising revenue for critical projects. I’m happy that transactions below 100gh are exempted, to provide some relief.”

Finance Minister Ken Ofori-Atta announced a new levy to be charged by government in 2022 on all electronic transactions to widen the tax net and rope in the informal sector.

“It is becoming clear there exists enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the ‘informal economy’,” Mr Ofori-Atta observed on Wednesday, November 17 as he presented the 2022 budget statement in Parliament.

“After considerable deliberations, government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector. This shall be known as the ‘Electronic Transaction Levy or E-Levy’.”

He explained that the new E-levy will be a 1.75 per cent charge on all electronic transactions covering mobile money payments, bank transfers, merchant payments and inward remittances to be borne by the sender except inward remittances, which will be borne by the recipient.

This will, however, not affect transactions that add up to GH¢100 pr less per day.

“A portion of the proceeds from the E-Levy will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others.”

This new levy is scheduled to start Saturday, January 1, 2022.

In 2020, total value of transactions was estimated to be over GH¢500 million with mobile money subscribers and users growing by 16 percent in 2019.

According to a Bank of Ghana report, Ghana saw an increase of over 120 percent in the value of digital transactions between February 2020 and February 2021 compared to 44 percent for the period February 2019 to February 2020 due to the convenience they offer.

This was definitely heightened by the advent of Covid-19 especially during the lockdown.

Source: 3news