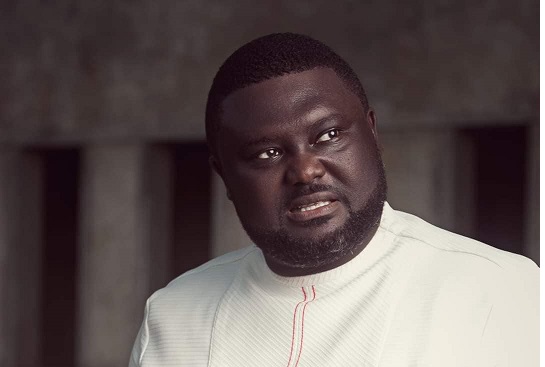

Ecobank Transnational Incorporated (ETI), has appointed Jeremy Awori as the new Chief Executive Officer of the Ecobank Group.

Mr Awori was appointed CEO of the Pan-African lender in September of last year, succeeding Ade Ayeyemi, who retired at the age of 60 in accordance with the bank’s policy.

Awori joins the Ecobank Group after a 25-year career in the banking industry, including nearly 10 years as Managing Director of Absa Bank Kenya Plc.

Experience

Prior to joining Absa, he held several senior positions at Standard Chartered Bank in the Middle East and Africa. He brings a wealth of banking experience, skills and expertise to the Ecobank Group

He joins Ecobank at a time it is angling for a larger market share as multinational banks exit the continent.

of its growth strategy. Despite current global challenges, Africa offers promising prospects. Ecobank is uniquely positioned to provide systematic change across the banking sector at a pan-African level, using the geographic footprint it has already established.”

Gateway

“Through our single gateway platform, we are well-positioned to provide the necessary financial products and solutions for countries, corporates, and SMEs to capitalise on the continent’s vast resource, trade and investment opportunities”.

He said the will under his management provide relevant, accessible, and affordable financial services that addresses the evolving needs of a vibrant, youthful, and entrepreneurial continent.

“Ecobank’s brand and heritage continue to be a source of pride”, he added.

Qualities

Chairman of the Ecobank Group Mr Alain Nkontchou said “Mr Jeremy Awori’s exceptional and proven qualities as a result-oriented effective leader with an extensive knowledge of the African banking landscape, make him the ideal choice to steer the growth of the Ecobank Group through the current era of rapid global and continental changes.”

The Group Chairman further noted that Jeremy has the full support of the ETI Board.

Ecobank is one of the largest banking groups on the continent outside of South Africa, with an asset base of $27.5 billion and more than 32 million customers in 33 markets across the continent.

Source: graphiconline