The Development Bank Ghana (DBG) has increased its loan book size to GH₵302 million since its establishment last year.

In the first quarter of this year, however, the bank has already disbursed an amount of GH₵57.2 to three participating financial institutions (PFIs) for onward lending to businesses in the agriculture and manufacturing sectors.

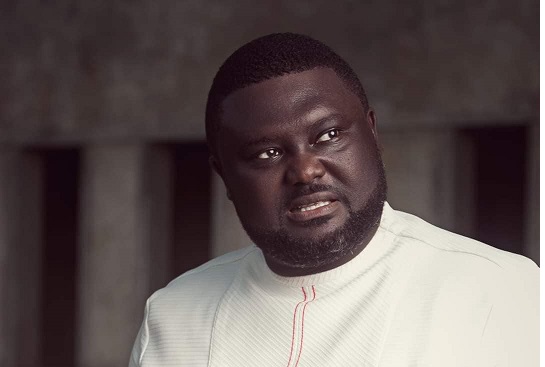

The Managing Director (MD) of the DBG, Kwamina Duker, who made this known said the move was in line with the bank’s agenda of spurring the growth of Small and Medium Enterprises (SMEs) in the country.

“Our priority is to accelerate lending activities and we have committed to disbursing at least ₵600 million in loans for on-lending to SMEs this year,” he said.

Mr Duker was speaking at an event organised by the DBG and the Ghana Association of Banks (GAB) in Accra on the theme; “Ghana’s Medium-Term Outlook, Navigating through Economic Uncertainties and an IMF Programme”.

“In the first quarter of the year, we increased our lending portfolio by disbursing GH₵57.2 million to three PFIs for onward lending to businesses in the Agriculture and Manufacturing sectors, bringing our loan book size to GH₵302 million,” he said.

Capacity building

Additionally, he said the bank had provided capacity building for 644 local businesses, including 444 young entrepreneurs, and 52 staff from 13 financial institutions during the quarter.

The training, he said, focused on various aspects of business management, entrepreneurship, and specialised lending to improve the sustainability and growth potential of SMEs, as well as enhance the lending capabilities of PFIs.

“We possess the capacity to provide additional loans to back sustainable projects as they are presented to us, demonstrating our unwavering dedication to growing with our partners and the bank will focus on sectors with high growth potential and significant social and environmental impact, such as agribusiness, manufacturing, and low-carbon and climate-resilient investments,” he said.

In addition, Mr Duker said the bank was working to increase its PFI network after onboarding Zenith Bank this year.

“We have completed due diligence and are on course to onboard Ecobank and Absa as new PFIs this month. DBG will continue to identify and onboard new PFIs to enhance our reach and ability to support SMEs across the country as we seek to have at least 10 PFIs by the end of the year,” he said.

He said another priority was to enhance the bank’s capacity-building initiatives.

As a result, he said the bank would intensify efforts to provide training and support to SMEs and PFIs, equipping them with the necessary skills and knowledge to succeed in their respective sectors.

Mr Duker said it would include offering training on business management, financial planning and environmental and social risk management to 15,000 businesses and entrepreneurs.

“We will work towards attaining relevant certifications and strengthening partnerships with stakeholders to promote sustainability in our operations,” he said.

Banking industry

The Chief Executive Officer (CEO) of the GAB, John Awuah, said the banking industry was committed to the embedment of a financial ecosystem that carried DBG on its wings via the assurance of an efficient financial services delivery through diligent discharge of its duties.

That, he said, would be in tandem with the basic tenets of DBG’s statutory requirements, guidelines and mandate.

“It is not an exaggeration to state, attempts towards the rapid transformation of the Ghanaian economy from this current state of the desirable path towards accelerated recovery, would require the concerted efforts of all key internal and external stakeholders,” he said.

Source: Graphiconline